Managing personal finances effectively requires deliberate planning and long-term thinking, especially when it comes to generating consistent income from investments. One of the most compelling income-generating strategies for modern investors is leveraging dividend-paying stocks. However, in order to maximize returns and make informed decisions, it is crucial to implement tools designed specifically for income forecasting—this is where the power of a dividend calculator comes into play.

Understanding Dividend Income

Dividends are regular payments made by companies to shareholders, often on a quarterly basis. These payments can form a reliable and passive stream of income, especially when reinvested over time. The big advantage? While stock prices may fluctuate, companies with strong balance sheets often maintain or even increase dividend payments, regardless of short-term market movements.

Many investors underestimate how impactful dividends can be in achieving financial goals such as early retirement, wealth accumulation, or living off investment income. With this in mind, having a system to project and evaluate your dividend earnings becomes not just useful, but essential.

The Role of a Dividend Calculator

A dividend calculator provides a precise method to project your annual income based on key variables including:

- Total investment amount

- Annual dividend yield

- Dividend frequency (monthly, quarterly, annually)

- Expected growth in dividends

- Reinvestment strategy (DRIP – Dividend Reinvestment Plans)

By inputting these variables, investors get immediate insights into how their capital is working for them—and what they can realistically expect in return. This data-driven approach leads to better structured portfolios, steadier cash flows, and ultimately greater peace of mind.

How It Helps Master Your Income Strategy

Incorporating a dividend calculator into your financial toolkit transforms your income strategy from vague notions to quantifiable outcomes. Here’s how it contributes to a smarter investment approach:

- Setting Clear Goals: Whether you’re planning for retirement in 20 years or aiming to cover specific monthly expenses through dividends, calculators help map out exactly how much capital and time is needed to reach those goals.

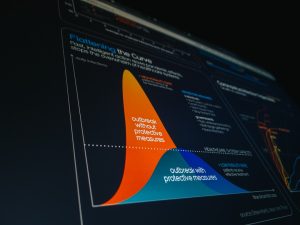

- Risk Management: With a clearer picture of income potential and sustainability, you’re better equipped to identify if your portfolio is overly reliant on high-yield, high-risk stocks.

- Scenario Analysis: Want to see the impact of reinvesting dividends versus taking them as cash? Curious how inflation or a dividend cut might affect your long-term plan? A good calculator helps you test all these situations.

Strategic Dividend Investing

Using a dividend calculator is much more powerful when integrated with a broader strategy. Here are a few key principles:

- Diversification: Avoid concentrating in one sector (e.g., telecom or utilities), even if yields are attractive.

- Quality Over Quantity: Focus on companies with strong fundamentals, a history of consistent dividends, and sustainable payout ratios.

- Long-Term View: Even modest dividend income can snowball when reinvested over years, making patience a major asset.

Many seasoned investors even design “dividend ladders” that ensure regular monthly income by combining stocks with staggered payment dates. Again, a calculator can illustrate how this impacts cumulative monthly or quarterly income flow.

Conclusion

Mastering your income strategy is not about chasing the highest yields or relying on gut feeling—it’s about discipline, data, and strategic thinking. A dividend calculator doesn’t just crunch numbers. It empowers you to shape a sustainable and predictable path toward financial independence.

If financial freedom is your goal, then let clarity and precision guide your investment journey. Take the time to explore the right tools, run the right numbers, and let each dividend earned take you a step closer to your long-term objectives. The calculator is merely the beginning—the strategy is what brings it all together.