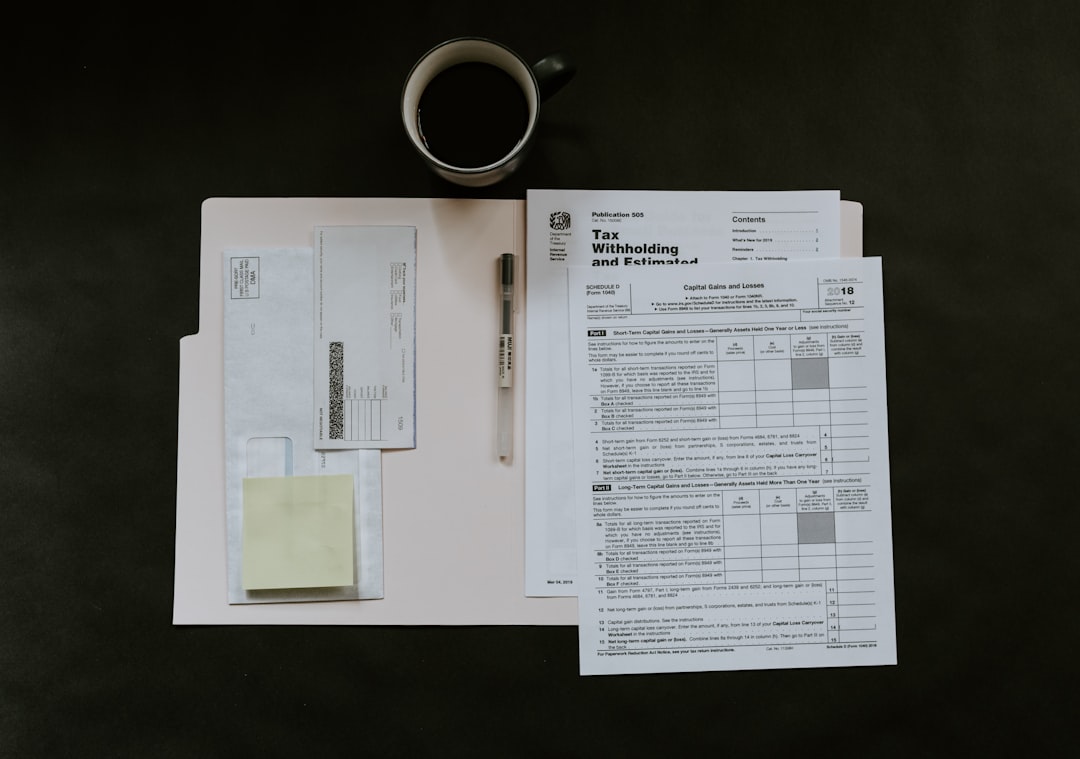

Managing taxes efficiently is a crucial aspect of any business’s financial process. When using an online billing system, setting up tax rates accurately ensures transparency, compliance, and smooth operations. Whether you’re a small business owner or managing invoicing for a larger organization, applying the right tax setup helps avoid accounting discrepancies and satisfies legal obligations.

To assist you in getting started, we’ll walk through the essential steps and considerations you should take to set up tax rates using an online billing platform. Keep in mind that tax rates vary by jurisdiction and may include federal, state, or regional taxes, depending on where your business operates.

1. Select a Trusted Online Billing Platform

First and foremost, choose a reliable online billing system that supports tax configurations. Most modern systems—such as QuickBooks, Zoho Invoice, FreshBooks, and Xero—include tax rate settings as part of their core invoicing features.

Look for the following attributes:

- Customizable tax rate settings

- Support for multiple tax types: sales tax, VAT, GST, etc.

- Automated tax calculation on invoices

- Jurisdiction-specific tax support

2. Gather Applicable Tax Information

Before entering any rates into your system, you’ll need to collect accurate and up-to-date tax information specific to your business location and industry. This may include:

- Sales tax percentages for your state or city

- Product- or service-specific tax rules

- Exemption criteria for certain clients or services

Check with your local revenue authority or consult a tax accountant to ensure your data is correct. Mistakes at this stage can have serious financial implications.

3. Configure Global and Item-Level Tax Rates

Most billing platforms allow you to configure tax rates globally (for all invoices) and at the item or service level. Setting global tax rates ensures a consistent application across all transactions, while item-level configuration is useful for handling tax-exempt goods or different tax categories.

To set up global tax rates, navigate to your billing software’s settings menu and locate the section labeled “Taxes“, “Sales Tax“, or similar. Create new tax rules by indicating:

- Tax name (e.g., “State Sales Tax”)

- Rate percentage (e.g., 7.5%)

- Jurisdiction (state, province, country)

- Is this tax compound? (if applicable)

For item-specific settings, you can assign different tax rates to products or services in your catalog so that the system applies the correct rate automatically during invoice generation.

4. Apply Tax Rules Based on Client Location

Tax regulations often vary based on the customer’s location. For example, an in-state sale may incur local sales tax, whereas an out-of-state or international transaction might be tax-exempt or subject to different rules.

Your billing platform should allow you to set tax rules relative to client billing addresses. Whenever you create or edit a client profile, ensure the address information is correct. The system can then automatically apply the right tax rate based on the user’s jurisdiction.

5. Consider Tax Grouping and Hierarchies

In several tax systems, multiple layers of taxes apply. For instance, a federal tax may be charged on top of a provincial tax. Online billing platforms refer to this as tax “grouping” or “stacked taxes”. You can create tax groups by combining individual tax rates in the correct order of application.

When establishing tax groups:

- Assign a name for the combined rate

- Select the included taxes within the group

- Ensure hierarchy is respected (e.g., compound taxes apply on top of other taxes)

6. Automate Tax Compliance and Reporting

One of the greatest benefits of modern billing systems is automated tax calculation and reporting. These tools generate tax reports that aid in monthly or quarterly filings and can alert you to potential inconsistencies. Some platforms even integrate with government portals to streamline compliance.

Use these functionalities to:

- Monitor tax collected over time

- Separate taxes by jurisdiction

- Export reports for your accountant

Final Thoughts

Setting up tax rates through an online billing system may seem complex, but with the right tools and a methodical approach, it becomes an efficient and scalable part of your invoicing process. Always stay informed about changes in tax laws and update your system regularly to maintain accuracy and compliance.

When in doubt, consult with a certified accountant or tax advisor to ensure you’re aligning with your local and international tax obligations. A well-implemented tax setup in your billing software not only keeps you compliant but also supports the financial health and professionalism of your business.