Thinking about getting a personal loan? Maybe you want to pay off credit cards, take a dream vacation, or tackle home repairs. But before you jump in, it’s smart to know what you’re signing up for. That’s where the Greater Personal Loan Calculator comes in. It makes loan planning super simple and a bit more fun too!

Why Use a Personal Loan Calculator?

A personal loan sounds nice, right? Cash in your account. Problem solved. But then come the monthly payments. Can you afford them? Will they stretch your budget? A loan calculator helps you see the future. Well, not like a crystal ball. But pretty close.

This tool shows you:

- Your monthly payment

- Total interest you’ll pay

- Total amount over the life of the loan

And the best part? You can change the numbers and see how it affects your payment instantly.

How It Works

It’s as easy as plugging in three numbers:

- Loan Amount: How much do you want to borrow?

- Interest Rate: What’s the annual rate you’re offered? (Example: 7.5%)

- Loan Term: How long do you want to pay it back? (Example: 3 years or 36 months)

Hit calculate and voilà! You’ll see exactly how much you’ll owe each month.

Let’s Try an Example

Say you borrow $10,000 at an interest rate of 8% and plan to pay it back over 5 years. Just punch those numbers into the calculator.

Your result? Around $202 a month.

But wait—over those five years, you’ll pay about $2,120 in interest! That means the total you’ll repay is $12,120.

Not bad if it helps you consolidate debt or fund something important. But that’s why seeing the full picture matters!

Change One Number, Change Everything

Want to pay less monthly? Pick a longer term. But heads up—you’ll probably pay more interest in the end.

Want to pay less total? Choose a shorter term. Your monthly payment goes up, but you save money overall.

It’s all about what fits your budget and your goals.

Why Interest Rate Matters So Much

Even a little difference makes a big impact.

A rate of 7% vs. 9%? That can change your total cost by hundreds—or even thousands—of dollars.

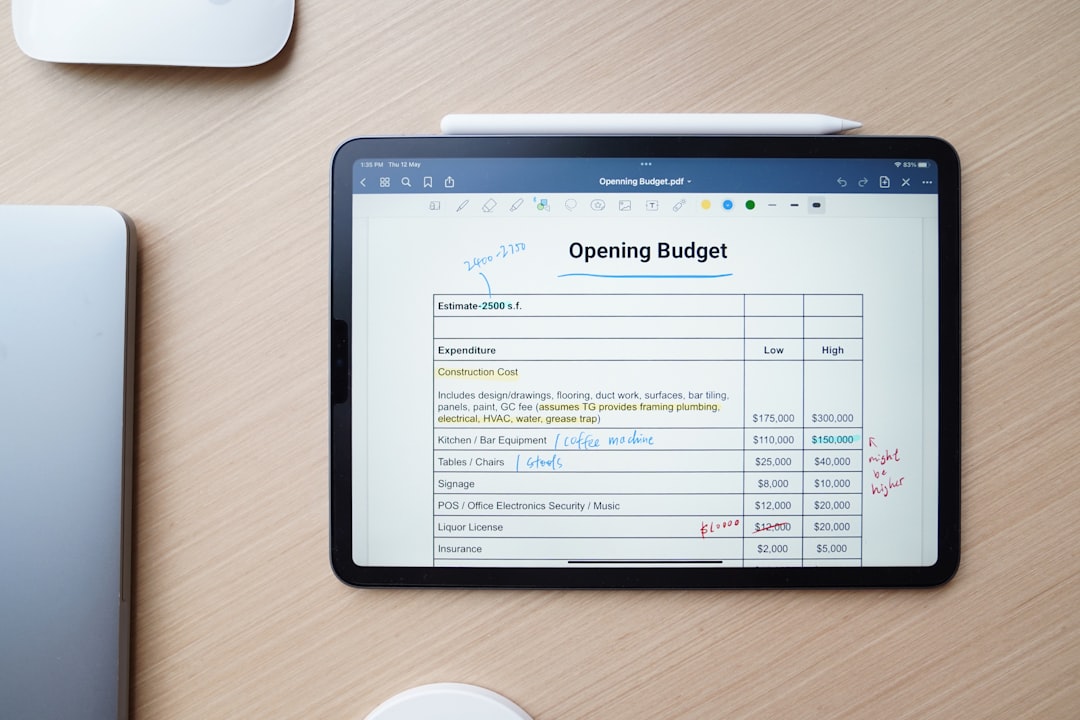

Here’s a quick comparison on a $15,000 loan over 3 years:

- At 7% = about $463/month and $1,670 total interest

- At 9% = about $477/month and $2,160 total interest

That’s $490 more in interest just from 2% difference!

Tips for Using the Greater Loan Calculator

Ready to crunch numbers like a pro? Try these simple tips:

- Don’t guess rates—check your credit score and get real offers.

- Try different terms to see how they affect your payment.

- Play with the loan amount. Can you borrow less and still meet your goal?

- Use realistic numbers that match your actual budget.

When a Loan Makes Sense

Not every situation needs a loan. But sometimes, it’s the perfect solution.

Think about using a personal loan for:

- Paying off high-interest credit cards

- Covering unexpected medical bills

- Paying for weddings, moves, or renovations

- Starting a small business or side hustle

Whatever your reason, a loan should help you, not stress you out. That’s why using a calculator is such a smart first step.

Watch Out for Extra Costs

Some loans come with extra fees. Like origination fees or early payoff penalties. Boo!

The calculator usually doesn’t include these. So be sure to ask your lender:

- Are there any fees rolled into the loan?

- Will I be penalized for paying early?

Better to know now than be surprised later.

Compare Before You Commit

Not all personal loans are created equal. That’s why smart shoppers compare multiple offers.

Use the calculator for each offer. Then stack them side by side:

- Which has the lowest total cost?

- Which fits your monthly budget best?

- Which one has fewer fees?

Let the numbers help you decide—no guesswork needed!

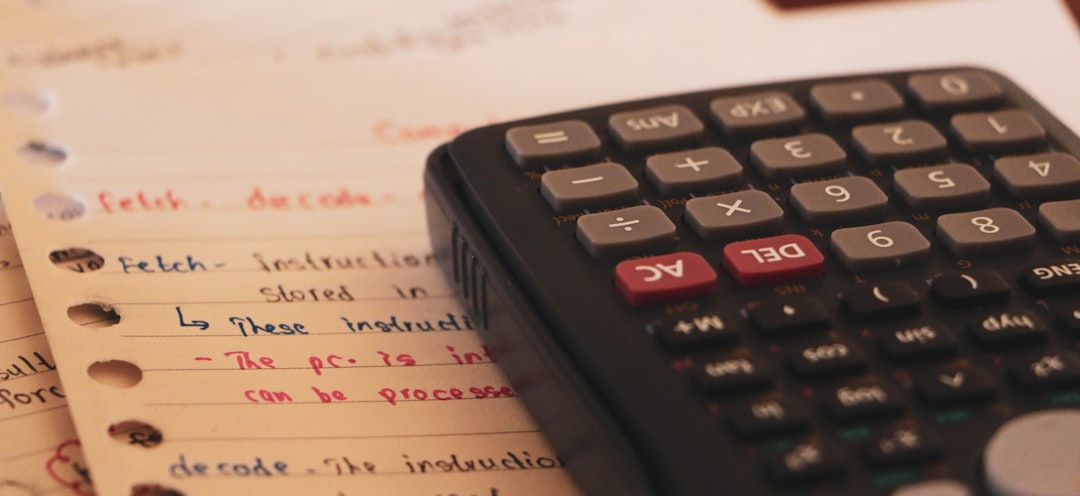

Doing the Math Yourself? Here’s the Formula

If you’re a math lover, here’s the loan payment formula:

Monthly Payment = (Loan x Rate) / (1 – (1 + Rate)-n)

Where:

- Loan = the loan amount

- Rate = monthly interest (annual rate ÷ 12)

- n = number of payments (months)

But honestly, it’s easier to let the calculator do the work.

The Bottom Line

Planning a personal loan doesn’t have to be scary or confusing. The Greater Personal Loan Calculator makes it quick, clear, and even kind of fun.

You’ll see what works for you—and avoid surprises later.

So take a minute, punch in your numbers, and see your future payment. That’s the smart move before saying yes to any loan!

Play with the calculator. Adjust the numbers. Find your sweet spot.

Then, go get the loan that fits you best.