Real estate finance can feel intimidating at first, filled with unfamiliar terms, large numbers, and long-term commitments. Yet, it is one of the most practical financial skills you can learn, whether you are buying your first home, considering a rental property, or simply trying to understand how property investments generate returns. This beginner-friendly guide breaks down the essentials, from mortgages and interest rates to cash flow and investment performance, so you can approach real estate with clarity and confidence.

TLDR: Real estate finance is about understanding how money moves in property buying and investing. Mortgages, interest rates, and down payments shape how you purchase property, while cash flow, appreciation, and leverage determine investment returns. By learning a few core concepts, beginners can make smarter decisions and reduce risk. The basics go a long way toward building long-term wealth.

What Is Real Estate Finance and Why It Matters

Real estate finance focuses on how properties are purchased, funded, and turned into financial assets. At its core, it answers three simple questions: How do you pay for a property?, How much does it really cost?, and What do you earn in return?

Unlike many other investments, real estate usually involves borrowed money. This means your financial outcomes depend not only on the property’s price, but also on loan terms, interest rates, taxes, insurance, and maintenance. Understanding these moving parts helps you avoid overextending yourself and allows you to spot opportunities that others might miss.

The Basics of Mortgages

For most buyers, a mortgage is the gateway into real estate. A mortgage is a loan secured by property, typically repaid over 15 to 30 years. While the concept is straightforward, the details matter.

Key mortgage components include:

- Principal: The amount you borrow.

- Interest: The cost of borrowing money, expressed as a percentage.

- Term: The length of time to repay the loan.

- Monthly payment: Usually includes principal, interest, property taxes, and insurance.

There are two common types of mortgages beginners encounter:

- Fixed-rate mortgages: The interest rate stays the same for the life of the loan, providing stability and predictable payments.

- Adjustable-rate mortgages (ARMs): The rate changes over time, often starting lower but carrying more uncertainty.

Choosing the right mortgage is about balancing affordability today with comfort in the future. A slightly higher fixed rate may offer peace of mind, while a lower adjustable rate may make sense if you plan to sell or refinance sooner.

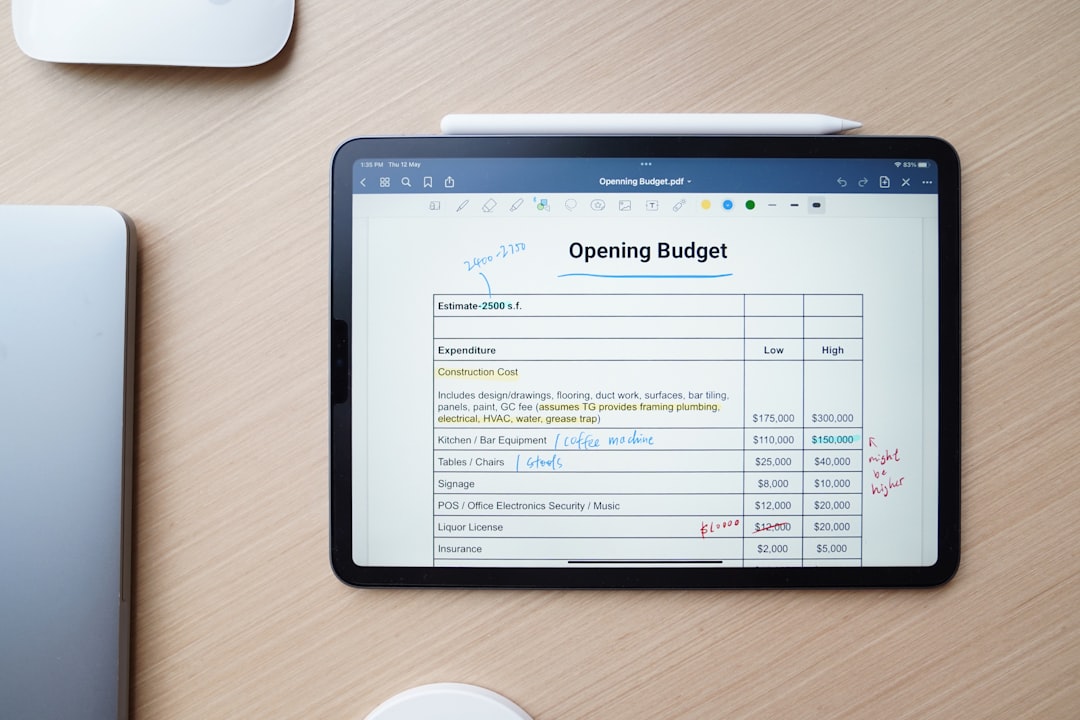

Down Payments, Closing Costs, and Hidden Expenses

Many beginners focus only on the home price and monthly payment, but upfront costs can significantly impact affordability. The down payment is the portion of the purchase price you pay upfront, typically ranging from 3% to 20% or more.

In addition to the down payment, buyers face closing costs, which may include:

- Loan origination fees

- Appraisals and inspections

- Title insurance and legal fees

- Prepaid taxes and insurance

Beyond closing, ongoing expenses matter just as much. Maintenance, repairs, homeowner association fees, and property taxes should always be part of your financial plan. A good rule of thumb is to budget conservatively so surprises do not derail your finances.

Understanding Cash Flow

Cash flow is one of the most important concepts in real estate investing. Simply put, it is the money left over after all expenses are paid. For rental properties, this calculation reveals whether a property supports itself financially.

Basic cash flow formula:

- Rental income

- Minus mortgage payments

- Minus taxes, insurance, maintenance, and management

If the number is positive, the property generates income each month. If it is negative, you are paying out of pocket to hold the investment. While some investors accept short-term negative cash flow for long-term appreciation, beginners often benefit from prioritizing properties that at least break even.

Leverage: Using Borrowed Money Wisely

One unique advantage of real estate is leverage, or using borrowed money to control a large asset. For example, with a 20% down payment, you control 100% of the property. If the property increases in value, your return is based on the full value, not just your initial contribution.

While leverage can boost returns, it also increases risk. Market downturns, vacancies, or unexpected repairs can strain your finances if your debt obligations are too high. The key is balance: leverage should amplify opportunity, not anxiety.

Smart leverage involves:

- Maintaining adequate cash reserves

- Choosing conservative loan terms

- Ensuring rental income comfortably covers expenses

Investment Returns Explained

Real estate returns come from several sources, not just monthly income. Beginners often find it helpful to view returns as a combination of different financial benefits.

Main types of real estate returns:

- Cash flow: Monthly or annual income after expenses.

- Appreciation: Increase in property value over time.

- Loan paydown: Tenants effectively reduce your mortgage balance.

- Tax advantages: Deductions and depreciation can improve net returns.

To evaluate performance, investors often look at metrics like cash-on-cash return or return on investment. These tools help compare properties and assess whether the numbers align with your financial goals.

Risk Management and Long-Term Thinking

Every financial decision carries risk, and real estate is no exception. Market shifts, interest rate changes, and local economic conditions all influence outcomes. However, real estate tends to reward patience. Long-term ownership has historically smoothed out short-term volatility.

Beginner-friendly risk management strategies include:

- Diversifying across property types or locations

- Maintaining emergency funds for repairs or vacancies

- Investing in areas with strong job and population growth

Rather than chasing quick profits, many successful investors focus on steady growth, reliable tenants, and sustainable financing. This mindset turns real estate from a gamble into a structured financial plan.

From First Purchase to Financial Confidence

The journey into real estate finance begins with understanding the basics and asking the right questions. Mortgages explain how properties are bought, cash flow reveals day-to-day performance, and investment returns show the bigger picture of wealth building.

For beginners, the most important step is education. By learning how financing affects long-term outcomes, you gain control over decisions that can shape decades of financial security. Real estate does not have to be complicated; with a solid foundation, it can become one of the most reliable tools in your financial life.