Managing debt can feel overwhelming, especially when juggling multiple loans, credit cards, and lines of credit with varying interest rates and payment due dates. That’s where a debt snowball spreadsheet template can be a game-changer. Designed to help you organize and systematically eliminate your debts, this powerful tool is a favorite among financial planners and individuals striving for financial freedom.

TL;DR

The debt snowball spreadsheet template helps you list and pay off debts from smallest to largest, creating momentum and motivation with each win. By entering your balances, interest rates, and minimum payments, the spreadsheet calculates your payoff plan. It’s a psychological and mathematical approach combined into a simple tool for anyone looking to take control of their financial life. With consistent use, this method can transform overwhelming debts into manageable milestones.

What Is the Debt Snowball Method?

The debt snowball method is a debt reduction strategy made popular by financial expert Dave Ramsey. It emphasizes paying off the smallest balance first, regardless of interest rate, to gain psychological traction and build momentum.

Here’s how it works:

- List all debts from the smallest balance to the largest.

- Continue making minimum payments on all debts.

- Put any extra money toward the smallest debt.

- Once that debt is paid off, apply its payment amount to the next smallest balance.

- Repeat until all debts are paid off.

Unlike the debt avalanche method, which targets high-interest debts first, the snowball prioritizes motivation over math. The quick wins from paying off smaller balances help people stay committed and energized.

Why Use a Debt Snowball Spreadsheet Template?

Keeping track of debts can be confusing without a system. A debt snowball spreadsheet template provides a centralized tool to:

- Organize all your debts in one place.

- Visualize your progress over time.

- Automate calculations such as balances and estimated payoff date.

- Plan for extra payments and adjust strategies as income or spending changes.

Using a template makes the process efficient and less intimidating. You’ll quickly understand where your money is going and what steps to take next.

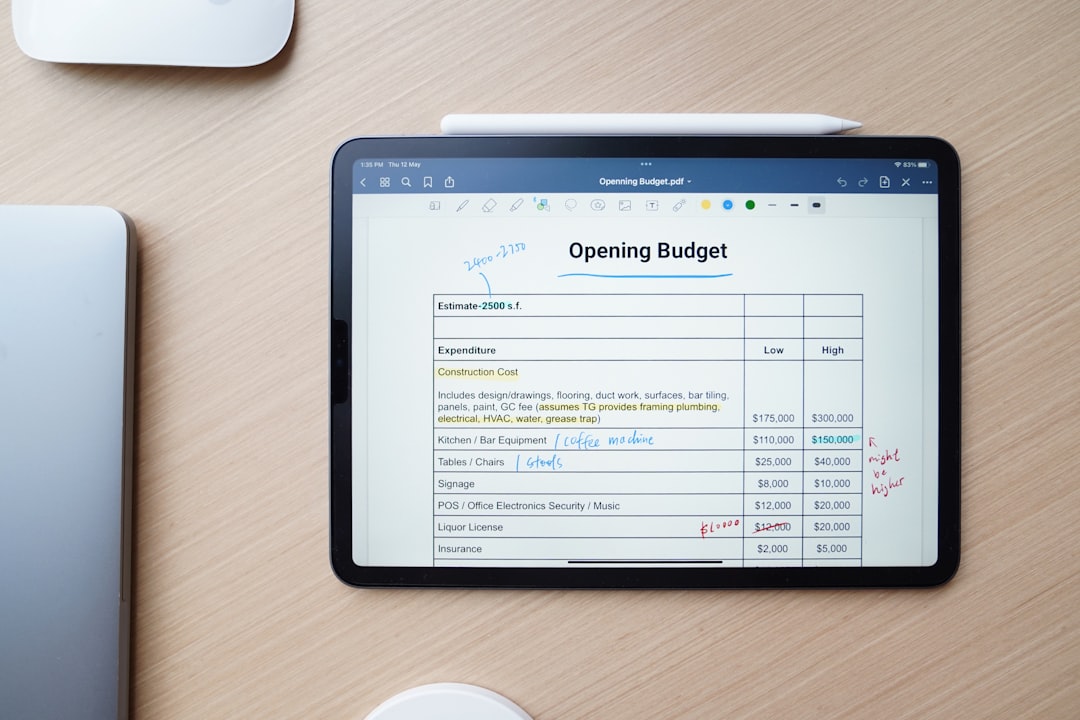

Key Components of a Debt Snowball Spreadsheet

A quality spreadsheet includes several essential elements:

- Debt Name: The source of the debt (e.g., Visa Card, Student Loan).

- Outstanding Balance: The total current amount owed.

- Minimum Payment: The required monthly payment.

- Interest Rate: For reference, although not the primary order driver in snowball.

- Payment Status/Tracker: To show progress over time.

- Extra Payment Field: For inputting any additional amounts paid monthly.

Some advanced templates even come with charts and graphs to visualize payoff trends.

How to Use a Debt Snowball Spreadsheet Template

Whether you’re using Google Sheets, Excel, or a cloud-based tool, the steps are quite simple. Here’s a breakdown:

Step 1: Download or Create Your Template

You can either download a free version available online or create your own. Many financial blogs and websites offer customizable templates compatible with Excel or Google Sheets. Choose one that fits your aesthetic and includes all key components.

Step 2: Gather Your Debt Information

Collect all your debt details, including:

- Creditor Name

- Current Balance

- Minimum Monthly Payment

- Interest Rate

- Due Dates

Having this at your fingertips will save time when entering the data into your spreadsheet.

Step 3: Enter Debts from Smallest to Largest

Ignore interest rates for now. The idea is to attack the smallest balances first for that quick satisfaction boost. Input your debts into the spreadsheet from the lowest balance to the highest.

Step 4: Plan and Apply Extra Payments

Determine how much extra money you can allocate above the minimum payments each month. Plug that value into your spreadsheet for the smallest debt. Once it’s paid off, the spreadsheet will show how that payment can roll into your next debt, like a snowball gaining size.

Step 5: Review and Stick With the Plan

Review the spreadsheet monthly. Update balances and note which debts are paid off. The consistent review will keep you motivated as you move down the list. Remember, personal finance is a marathon, not a sprint.

Tips for Maximizing Success with the Debt Snowball Spreadsheet

The spreadsheet is a tool—your behavior determines its impact. Here are some tips to make the most out of it:

- Be Honest About Spending: If you’re tracking debt, also track where your money goes each month to find areas where you can free up cash.

- Automate Payments: Wherever possible, set up auto-pay to avoid missed or late payments.

- Celebrate Small Wins: Each debt you pay off should be celebrated. It marks progress.

- Avoid New Debt: This may sound obvious, but staying out of new debt is crucial when you’re working on paying off existing ones.

Common Mistakes to Avoid

Even with a spreadsheet, mistakes can happen. Here’s what to watch out for:

- Only Paying Minimums: The snowball method thrives on extra payments. Only paying the minimum delays progress.

- Forgetting to Update: A neglected spreadsheet won’t reflect your real progress or areas of concern.

- Not Budgeting: The spreadsheet is for strategizing. Pair it with a monthly budget to ensure you’re freeing up actual cash for debt elimination.

- Choosing the Wrong Order: Don’t reorder based on interest rate; that’s a different method (debt avalanche). Stick with smallest to largest for snowball success.

Benefits of Using a Debt Snowball Spreadsheet

Users of the debt snowball method often report not just financial clarity but also unexpected emotional benefits:

- Confidence: Seeing progress builds belief that you actually can become debt-free.

- Organization: Everything in one place removes the dread of facing an unorganized financial mess.

- Accountability: Whether solo or with a financial advisor or partner, this tool keeps you on track.

- Customizability: You can adapt the spreadsheet to include charts, progress bars, or motivational quotes!

Where to Find Free Debt Snowball Spreadsheet Templates

Resources to find great templates include:

- Google Sheets Template Gallery – search “debt payoff” or “snowball”.

- Reddit Communities like r/personalfinance often share downloadable links.

- Blogs such as BudgetsAreSexy or CleverGirlFinance frequently offer free customizable templates.

- Excel Templates from the Office website often have polished options with pre-built formulas.

Be sure to choose one from a reputable source. If downloading, scan files before opening just to be safe.

Final Thoughts

A debt snowball spreadsheet template isn’t just an Excel file—it’s a roadmap to debt freedom. With every line item you mark as “Paid,” you’re inching closer to financial independence. Think of it as your personal financial journal; one where every victory is recorded and celebrated.

Combining this spreadsheet with discipline, a solid budget, and the right mindset can help you conquer even the most intimidating mountain of debt. Take the first step today—download or create your template, and let the snowballing begin!